Sale Profit: The projected profit the owner will make upon the sale of the investment property after the holding period.Projected Cash Flows: The annual income of a rental property you are expected to make.

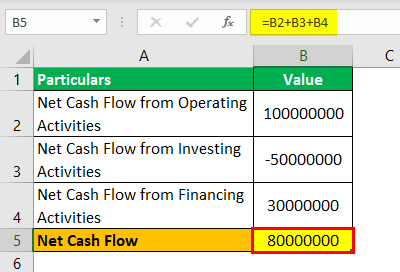

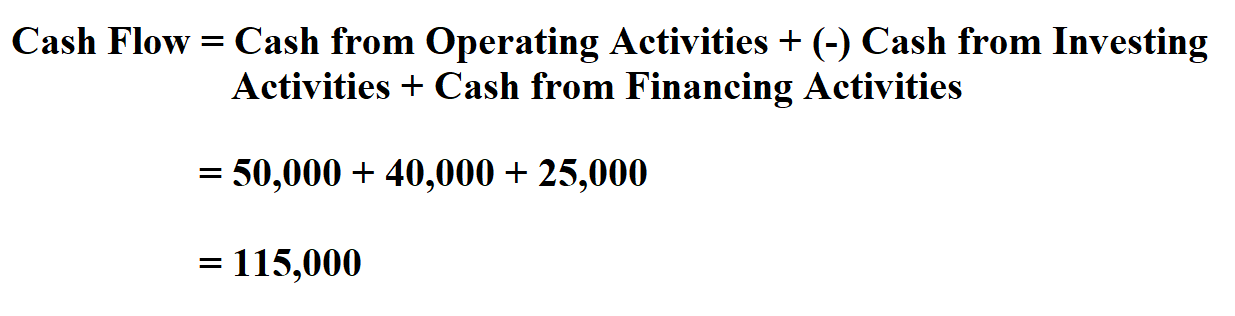

Financing Costs: Any costs within the initial purchase or expected costs after, usually interest rate costs.Holding Period: The Holding Period is typically used for investment properties between 5-15 years, although it can change depending on the type of real estate investment or investor.Initial Cost: The Initial Cost is either the purchase price of the property or the closing costs.Below are some metrics to keep in mind during your calculations. When you are doing your calculations for your discounted cash flow approach formula, it is essential to include all of the correct information. What Should Be Included in the Discounted Cash Flow Formula? Basically, the discounted cash flow formula is used to obtain the NPV and predict cash flow for the future.īelow is the formula for discounted cash flow: The cash flow formula is usually used in conjunction with the Net Present Value or NPV. It is done by attempting to figure out how much cash it will produce in the future. Overall, the discounted cash flow analysis formula helps to figure out the value of a company or investment. The discounted cash flow helps to form the estimated current value of the investment property.

It does so by projecting the income of a property for the future. Also, it even goes as far as to help predict the viability of an investment. The discounted cash flow formula is a commonly used calculation in real estate investing that serves to determine how profitable an investment can be. Then, we will discuss some additional important features of investing and where to find such tools. In this article, we will look at what the discounted cash flow formula is and how it is an essential aspect of real estate investing. What Other Calculations Should I Be Using for My Real Estate Investments?.What Counts as a Good Discounted Cash Flow?.

#Discount free cash flow formula how to

0 kommentar(er)

0 kommentar(er)